Elevator Market Analysis

Global Elevator Market Analysis (2024)

1. Executive Summary

The

global elevator market is a mature yet dynamically growing sector,

intrinsically linked to global urbanization, infrastructure development,

and technological advancement. Driven by rising construction in

emerging economies, the need for urban mobility solutions, and the

modernization of existing building stock, the market presents

significant opportunities. Key trends shaping the future include

digitalization, energy efficiency, and a shift towards service-oriented

business models. While the market is highly competitive and consolidated

among a few major players, innovation in areas like smart elevators and

predictive maintenance is creating new avenues for growth.

2. Market Overview & Size

Market Size (2023): The global elevator and escalator market was valued at approximately USD 110-120 billion.

Projected Growth (CAGR):

The market is expected to grow at a Compound Annual Growth Rate (CAGR)

of 5-7% from 2024 to 2030, potentially reaching USD 160-180 billion by

the end of the forecast period.

Key Segments:

By Type: Elevators, Escalators, and Moving Walkways.

By Elevator Technology:

Traction (Geared & Gearless), Hydraulic, and Machine-Room-Less

(MRL). MRL traction systems are becoming the standard for mid to

high-rise buildings due to space and energy savings.

By Application: Residential, Commercial, Industrial, and Institutional. The residential segment holds the largest market share globally.

3. Key Market Drivers

Rapid Urbanization & Population Growth:

The ongoing migration to cities, particularly in Asia-Pacific and

Africa, is fueling the construction of high-rise residential and

commercial buildings, directly driving demand for new elevator

installations.

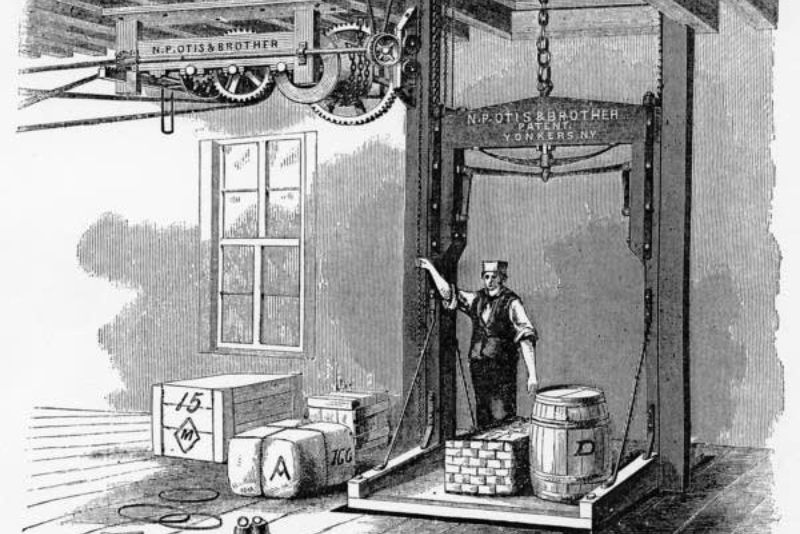

Aging Infrastructure & Modernization:

In developed regions like North America and Europe, a significant

portion of the elevator installed base is old and inefficient. The need

for safety upgrades, improved performance, energy savings, and

regulatory compliance is creating a robust modernization and retrofit

market.

Technological Advancements (Smart Elevators):

The integration of IoT (Internet of Things), AI (Artificial

Intelligence), and cloud computing is revolutionizing the industry.

Smart elevators offer features like destination dispatch control,

predictive maintenance, remote monitoring, and enhanced passenger

experience (e.g., touchless controls, biometrics).

Focus on Energy Efficiency & Green Buildings:

Sustainability certifications like LEED and BREEAM are pushing demand

for energy-efficient elevators. Technologies such as regenerative

drives, which feed energy back into the building's grid, are gaining

traction.

Government Investments in Infrastructure:

Public investments in transportation hubs (airports, metro stations),

hospitals, and public buildings continue to generate steady demand for

elevators and escalators.

4. Major Challenges & Restraints

High Initial Investment & Installation Costs:

The capital expenditure for high-speed, advanced elevator systems is

significant, which can be a barrier, especially in cost-sensitive

markets.

Stringent Regulatory and Safety Standards:

The industry is heavily regulated with strict safety codes (e.g., EN 81

in Europe, ASME A17.1 in the U.S.), which can complicate and slow down

new product development and installation.

Cyclical Nature of the Construction Industry:

The elevator market is directly tied to the health of the construction

sector. Economic downturns or a slump in real estate can immediately

impact new equipment sales.

Skilled Labor Shortage:

There is a growing global shortage of qualified technicians for

installation, maintenance, and repair, which can affect service quality

and operational efficiency.

5. Key Trends

Servitization and the Maintenance Boom:

The business model is shifting from a one-time sale to a long-term

service relationship. Maintenance, repair, and modernization contracts

now represent the largest and most profitable segment for major OEMs,

providing recurring revenue streams.

Predictive Maintenance:

Using IoT sensors and data analytics, companies can predict component

failures before they happen, reducing downtime, improving safety, and

optimizing maintenance schedules.

Touchless and Hygienic Solutions:

The COVID-19 pandemic accelerated the adoption of touchless

technologies such as smartphone-controlled calling, voice activation,

and UV-C light disinfection systems within elevator cabins.

Mobility-as-a-Service (MaaS) Integration:

In smart buildings, elevators are being integrated with building

management systems (BMS) to optimize passenger flow, for example, by

coordinating with ride-hailing apps or parking services.

6. Competitive Landscape

The market is an oligopoly, dominated by four major multinational corporations, often referred to as the "Big Four":

Otis Worldwide Corporation (USA)

Schindler Group (Switzerland)

TK Elevator (TKE) (Germany)

KONE Corporation (Finland)

Other notable players include: Mitsubishi Electric (Japan), Fujitec (Japan), and Hitachi Ltd. (Japan).

Competitive Strategy: Competition is intense and based on:

Service Network: The breadth and quality of maintenance and service operations.

Technology & Innovation: Leadership in smart and green elevator solutions.

Geographical Presence: Strong global footprint, especially in high-growth emerging markets.

Cost Efficiency: Competitive pricing for new installations to secure long-term service contracts.

7. Regional Analysis

*

**Asia-Pacific:** The **largest and fastest-growing** market,

accounting for over 60% of global demand. Dominated by China, India, and

Southeast Asian countries due to massive urbanization and construction

booms.

* **Europe:** A **mature market** characterized by a strong

focus on modernization, stringent safety regulations, and demand for

energy-efficient solutions. Germany, France, and the UK are key markets.

*

**North America:** Another mature market with a huge installed base,

making **modernization and maintenance** the primary growth drivers. The

U.S. is the largest national market in the region.

* **Latin

America & Middle East & Africa:** These are **emerging markets**

with strong growth potential, driven by urban development and

infrastructure projects in key countries like Brazil, UAE, and Saudi

Arabia.

8. Conclusion & Future Outlook

The global

elevator market is on a stable growth trajectory, transitioning from a

hardware-centric industry to a service and solution-oriented one. The

future will be defined by:

* **The "Connected Elevator":**

Elevators will become integral nodes in the smart building ecosystem,

constantly communicating data for optimization.

* **Sustainability

as a Standard:** Energy-efficient and low-carbon footprint solutions

will become a baseline requirement, not a premium feature.

* **Enhanced User Experience:** Personalized, seamless, and safe passenger journeys will be a key differentiator.

While

the "Big Four" will continue to dominate, technological disruption and

the specific needs of emerging economies will create opportunities for

agile innovators and regional players. The core of the business,

however, will remain the highly profitable and stable maintenance and

service segment.